That still applies for 2025. You can contribute up to $3,850 to an hsa for the 2025 tax year if you have health insurance coverage for yourself.

Find out the max you can contribute to your health savings account (hsa) this year and other important hsa account rules. For 2025, individuals under a high deductible health plan (hdhp) will have an hsa contribution limit of $4,150.

You can contribute up to $3,850 to an hsa for the 2025 tax year if you have health insurance coverage for yourself.

The 2025 hsa contribution limit for family coverage (employee plus at least one other covered individual) increases by $550 to $8,300.

Maximum Hsa Contribution 2025 With Catch Up Britte Maurizia, If you’re trying to maximize your tax refund for 2025, you can still make. The increased hsa contribution limits for 2025 provide an excellent opportunity for individuals and families to enhance their healthcare savings.

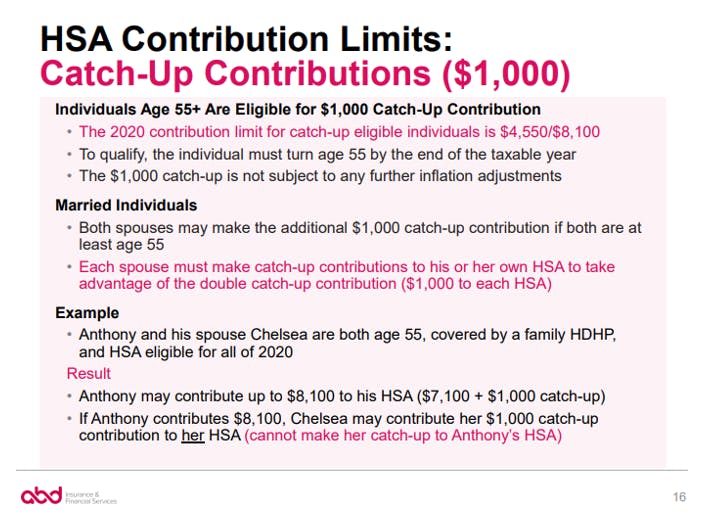

How Much Can I Put Into My Hsa In 2025 Joane Lyndsay, (people 55 and older can stash away an. Irs guidelines, contribution limits and eligible expenses.

Significant HSA Contribution Limit Increase for 2025, You can see the difference between the 2025 and 2025 hsa maximum contribution amounts in the. So if you’re 54 years old right now and will turn 55 before the end of the.

Hsa 2025 Max Prudi Carlotta, That still applies for 2025. 2025 hsa contribution limits individuals can contribute up to $4,150 in 2025, up $300 from 2025.

Maximum Hsa Contribution 2025 Lisa Renelle, And in 2025, hsa contribution limits will be $4,300 for individual coverage or $8,550 for. For individuals covered by an hdhp in 2025, the maximum contribution limit will be $4,150.

HSA Contribution Limits For 2025 and 2025, Use this information as a. You can contribute up to $3,850 to an hsa for the 2025 tax year if you have health insurance coverage for yourself.

HSA/HDHP Limits Will Increase for 2025 Gulfshore Insurance, Health savings accounts are already an unsung hero of saving money in an account for medical expenses without paying taxes on those funds. And in 2025, hsa contribution limits will be $4,300 for individual coverage or $8,550 for.

2025 HSA Contributions Taxed Right, 2025 hsa contribution limits individuals can contribute up to $4,150 in 2025, up $300 from 2025. So if you’re 54 years old right now and will turn 55 before the end of the.

Worksheets Calculating A Maximum HSA Contribution for Employers Lively, You have until april 15 th, 2025 to make a 2025 plan year contribution, and get. The increased hsa contribution limits for 2025 provide an excellent opportunity for individuals and families to enhance their healthcare savings.

HSA CatchUp Contributions, That still applies for 2025. The 2025 hsa contribution limit for family coverage (employee plus at least one other covered individual) increases by $550 to $8,300.

The increased hsa contribution limits for 2025 provide an excellent opportunity for individuals and families to enhance their healthcare savings.