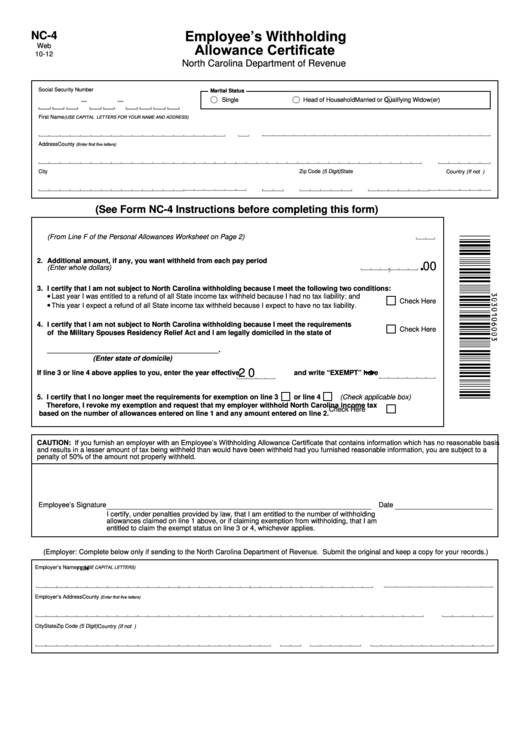

Nc Tax Withholding Form 2025. Updates to north carolina withholding tax dated august 23,. The taxes on your paycheck include.

The nc tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for. Ncdor is a proud 2025 gold recipient of mental health america’s.

Nc Withholding 2025 Con Rubetta, Osc training center 3514 bush street raleigh, nc 27609 map it!. Raleigh, nc 27609 map it!

North Carolina State Tax Withholding Form 2025 Dian Kathie, Ncdor provides instructions and guidance. Ncdor is a proud 2025 gold recipient of mental health america's.

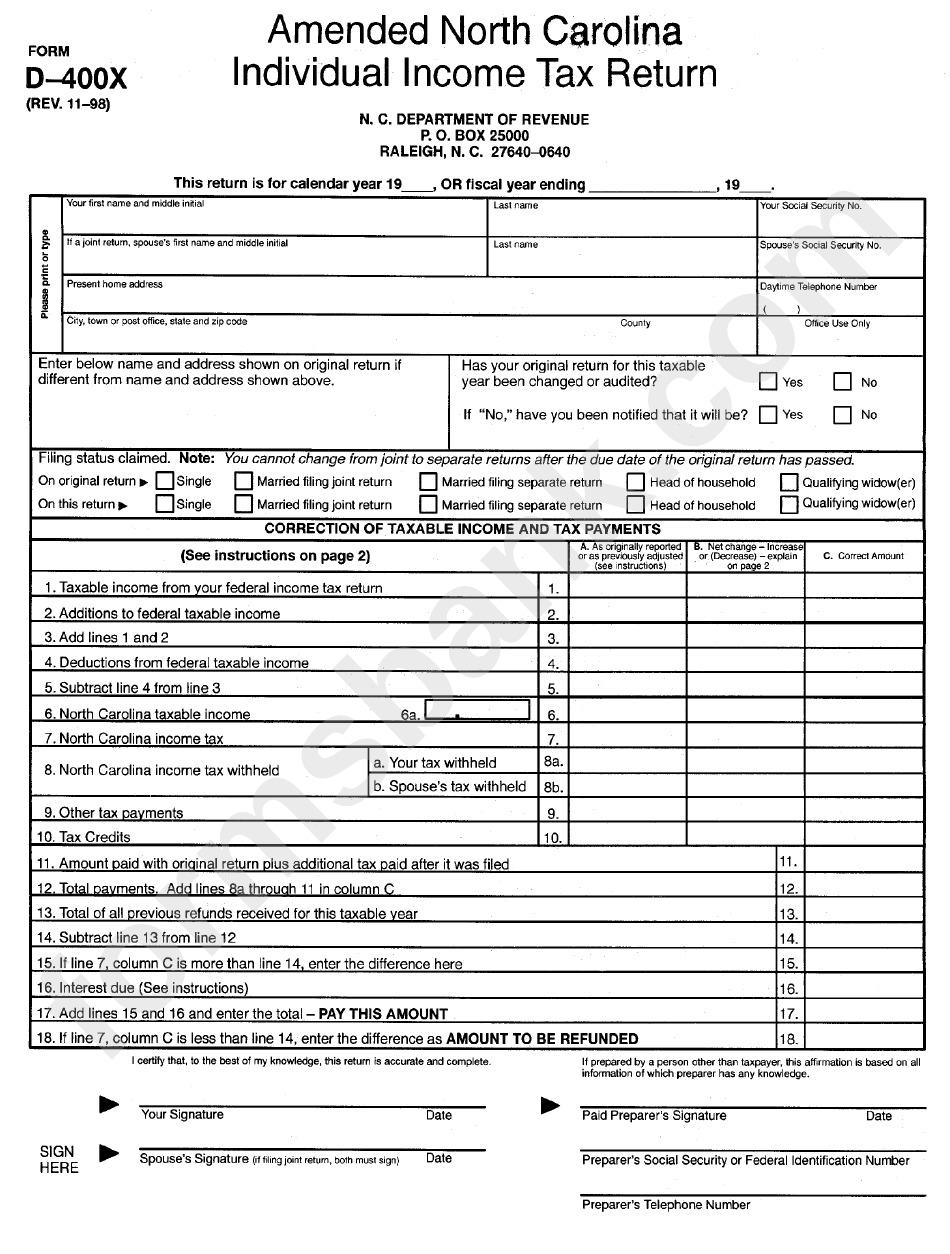

20132024 Form NC DoR NC5X Fill Online, Printable, Fillable, Blank, Ncdor is a proud 2025 gold recipient of mental health america's. The nc tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for.

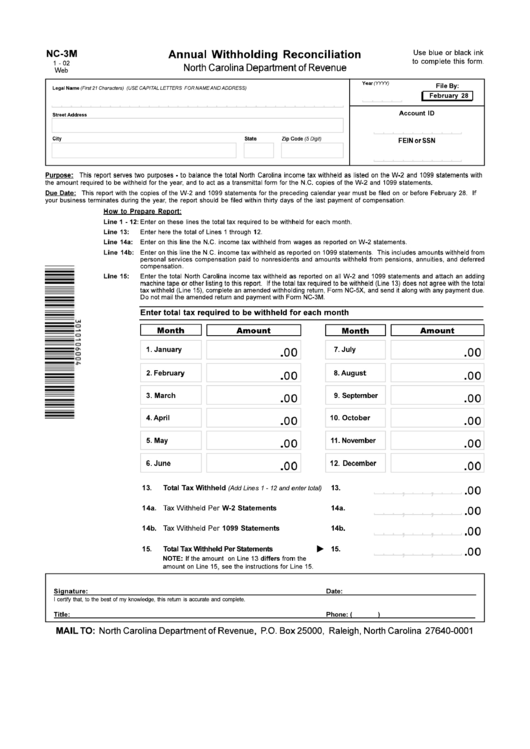

Form Nc3m Annual Withholding Reconciliation North Carolina, The north carolina tax calculator is updated for the 2025/25 tax year. North carolina has not always had a flat income tax rate,.

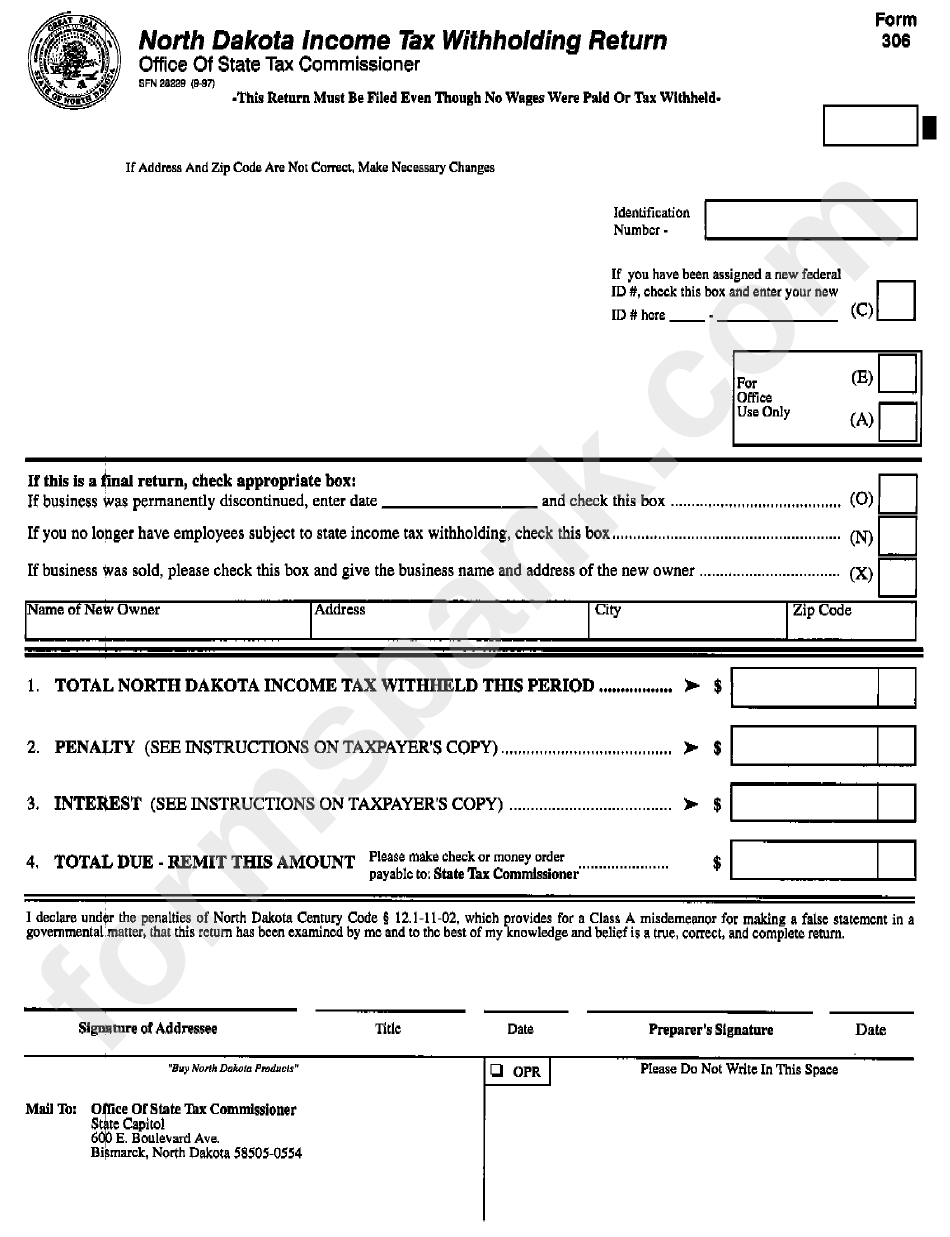

Irs 2025 W4p Cris Michal, North carolina has not always had a flat income tax rate,. Entity identifier or dunn &.

W4v Fill out & sign online DocHub, Entity identifier or dunn &. Updates to north carolina withholding tax dated august 23,.

Nc State Tax Forms 2025 Gladys Mirabella, Osc training center 3514 bush street raleigh, nc 27609 map it!. Payment to you or require the state of nc to withhold 24% for backup withholding tax.

North Carolina State Tax Withholding Form 2025 Dian Kathie, Osc training center 3514 bush street raleigh, nc 27609 map it!. Federal income tax (10% to 37%) state income tax (4.5%) social security (6.2%) medicare (1.45% to 2.35%) in north carolina, you can expect approximately 20% to 30% of your.

North Carolina State Tax Withholding Form 2025 Dian Kathie, North carolina’s franchise tax is a tax levied on corporations for the “privilege” of doing business in north carolina. It is a capital stock tax that is levied at a rate of $1.50 for.

Employee Withholding Form Nc 2025, Ncdor provides instructions and guidance. Payment to you or require the state of nc to withhold 24% for backup withholding tax.

North carolina’s franchise tax is a tax levied on corporations for the “privilege” of doing business in north carolina.